Challenges for founders and CTO

Resource and budget pressure

Efficient solutions without large hardware costs or expensive maintenance contracts are required to reduce costs and invest capital in key areas.

Quick scalability

New features often have to be rolled out in a very short time. Founders and CTOs need flexible solutions that can be seamlessly adapted as transactions increase.

Data security and compliance

GDPR compliance and encrypted data processing are a must to minimize legal risks and protect the company's reputation.

Central data storage

Silos in various systems make consistent, data-based decision-making difficult. An integrated, cloud-based infrastructure provides a remedy here.

How to integrate our digital document services into your tech architecture

Microservices & APIs

Our solution communicates with your backend or POS system via standardized REST APIs. All relevant data is collected and processed in real time.

Cloud-based infrastructure

We rely on scalable, cloud-native platforms to ensure high availability and flexibility. As transaction numbers grow, the infrastructure can be expanded as needed.

Easy connection & SSO

Thanks to state-of-the-art authentication and authorization mechanisms (e.g. OAuth 2.0), seamless logins and customer identifications can be realized.

Modularity & SDKs

Our SDKs for various programming languages and platforms (e.g. Java, .NET, Node.js) enable rapid integration into your existing app or web landscape.

Strategic & economic benefits

Quick time-to-market

With our ready-made modules and APIs, you can reduce development time and bring innovations to market faster.

cost efficiency

Avoiding thermal paper, minimizing hardware overhead and automated processes significantly reduce your operating costs.

scalability

As user and transaction numbers grow, your solution remains performant and reliable - without complex system refactorings.

Sustainability through innovation

Data-driven innovation

Transaction data generated in real time provides the basis for advanced analytics and AI-based services - from recommendation engines to predictive analytics.

Sustainability & ESG

As a digital company, you strengthen your green image, rely on resource-saving processes and meet ESG requirements - a factor that impresses founders, investors and customers alike.

POS Partners

Our partners include leading providers of cash register systems. Thanks to the seamless integration of anybill, they easily expand their offering with digital, legally compliant documents and modern features. In this way, your existing infrastructure is optimally supplemented and you offer your customers an innovative service with clear paper and cost savings.

Software Partners

Providers of CRM, ERP or marketing systems integrate detailed transaction data from anybill. Use this real-time document data and customer interactions to optimize campaigns, create personalized offers based on real purchase data, and sustainably strengthen customer loyalty.

Financial Partners

Our solutions are compatible with common banks, payment service providers and card issuers. These partners provide innovative customer benefits by linking payment cards with digital receipts - for unique card-linked loyalty programs or automated processes such as expense reporting. In this way, you support all common payment methods with additional, paperless convenience.

Proven in practice - digital documents in use

Omnichannel connection

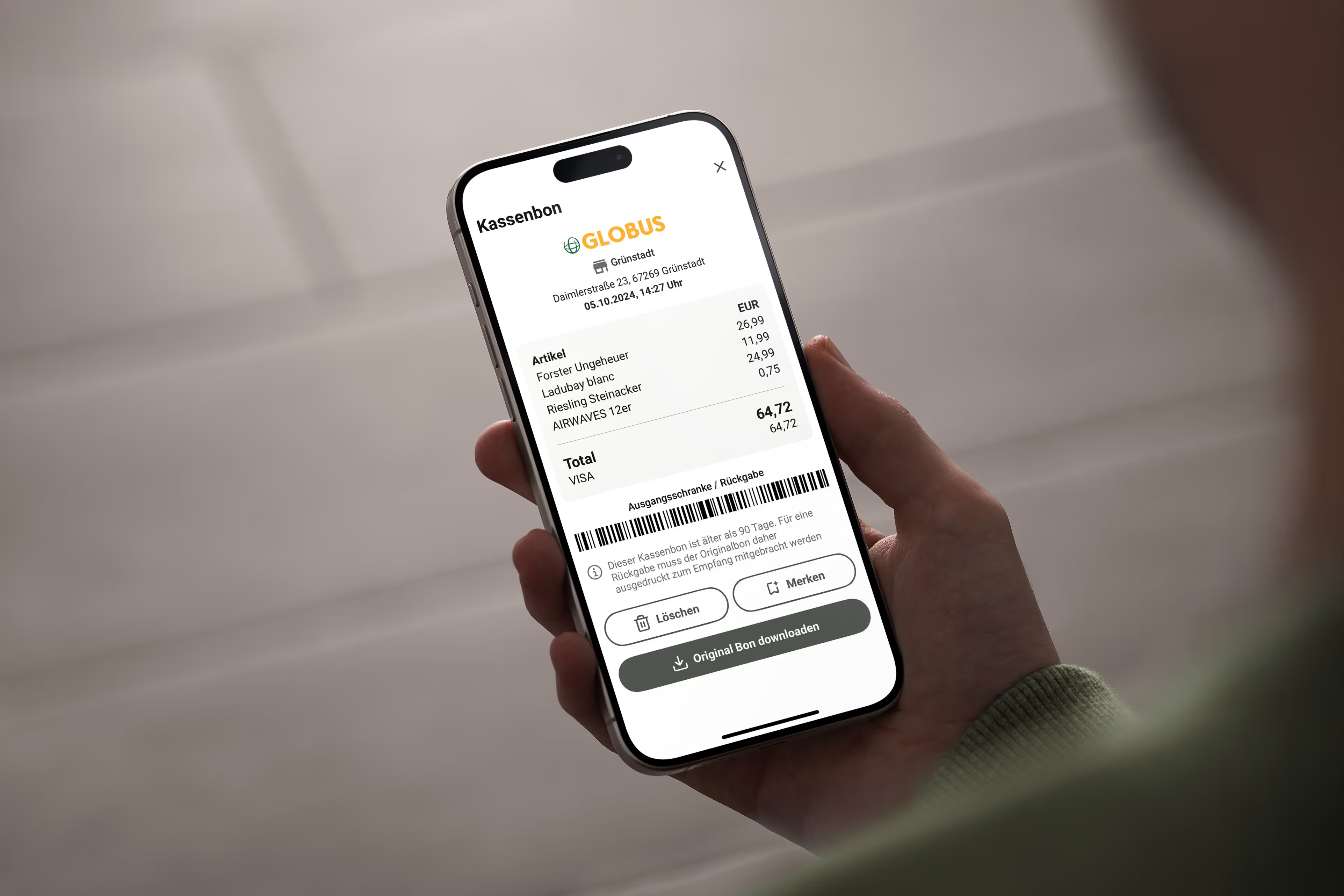

Companies like GLOBUS use the digital document to seamlessly direct customers to their “my GLOBUS” app after shopping in the market, to connect customer cards and thus strengthen the digital customer journey (over 30,000 registrations in the first week).

Loyalty integration

Through partnerships, digital receipts can be integrated directly into leading loyalty programs, which makes participation easier and allows data to be used for personalized rewards.

Thanks to our standardized APIs and extensive SDKs, initial functionalities can usually be integrated and tested within a few days.

Not usually. Our solution uses existing hardware (e.g. customer display, terminal) and connects it to our cloud services via software adaptation.

We use the latest encryption methods and operate our infrastructure in certified data centers. GDPR compliance is an integral part of our service offering.

Yes - we offer open REST APIs and SDKs that provide seamless connectivity to CRM, analytics, loyalty modules, and other services.

Our cloud-native architecture automatically scales as transaction volumes increase. In addition, you benefit from real-time data, which you can use for personalized offers, AI-based process optimization and reporting.